Economy

Related: About this forumLeading Economic Indicators down 0.1% in May after declining 1.4% in April, Conference Board, 6/20/25

Last edited Sat Jun 21, 2025, 01:23 AM - Edit history (1)

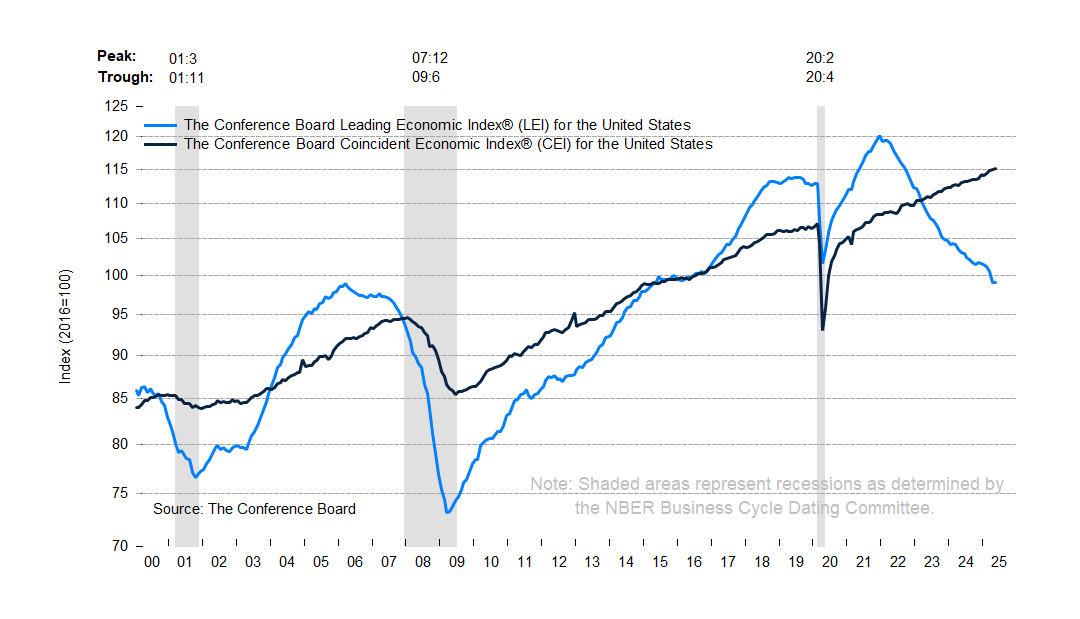

https://www.conference-board.org/topics/us-leading-indicatorsThe Conference Board Leading Economic Index® (LEI) for the US ticked down by 0.1% in May 2025 to 99.0 (2016=100), after declining by 1.4% in April (revised downward from –1.0% originally reported). The LEI has fallen by 2.7% in the six-month period ending May 2025, a much faster rate of decline than the 1.4% contraction over the previous six months.

. . . “The recovery of stock prices after the April drop was the main positive contributor to the Index. However, consumers’ pessimism, persistently weak new orders in manufacturing, a second consecutive month of rising initial claims for unemployment insurance, and a decline in housing permits weighed on the Index, leading to May’s overall decline. With the substantial negatively revised drop in April and the further downtick in May, the six-month growth rate of the Index has become more negative, triggering the recession signal. The Conference Board does not anticipate recession, but we do expect a significant slowdown in economic growth in 2025 compared to 2024, with real GDP growing at 1.6% this year and persistent tariff effects potentially leading to further deceleration in 2026.”

The Conference Board Coincident Economic Index® (CEI) for the US inched up by 0.1% in May 2025 to 115.1 (2016=100), after a 0.2% increase in April. The CEI rose by 1.3% over the six-month period between November 2024 and May 2025, more than twice as fast as its 0.5% growth over the previous six months. The CEI’s four component indicators—payroll employment, personal income less transfer payments, manufacturing and trade sales, and industrial production—are included among the data used to determine recessions in the US. Industrial production was the weakest contributor to the index in May and the only CEI component declining.

My emphasis added.

There's a graph of the LEI and the CEI (Coincident Economic Indicators) at the link. The LEI has been dropping in an almost straight line since January 2022, according to this graph.

Edited to add - Here's the graph

Recession it is .

🫤

✌🏻

progree

(12,736 posts)Last edited Fri Jun 20, 2025, 11:31 AM - Edit history (1)

The Conference Board isn't, they are predicting 1.6% economic growth overall in 2025. Given the Q1 estimate of minus 0.2% GDP (annualized), that means a 2.2% average growth rate in the remaining 3 quarters of the year to make up for that and get to 1.6% for the year. (By the way, there is one more estimate of Q1 GDP to go, coming out near the end of this month. So the -0.2% number for Q1 isn't final).

Neither is the Atlanta Fed's GDPNow model nor the Blue Chip consensus they follow for comparison..

https://www.atlantafed.org/cqer/research/gdpnow

And just to head off a common myth -- that 2 negative quarters in a row equals a recession, no, recessions are determined by the National Bureau of Economic Research (NBER), not by popular Internet memes:

https://www.democraticunderground.com/10143450417#post20

Not that anyone credible is predicting Q2 GDP growth to be negative. Sadly, we won't know how Q2 turns out until the first estimate of that is released near the end of July. The second estimate comes out near the end of August and the third and final estimate near the end of September.

Edited to add: Myself, I think a recession will start sometime in 2025 as ultimately determined by the NBER. I don't know how the heck we can have all these tariff ups and downs and ups and downs, plus immigration enforcement U-turns and U-turns on U-turns without having one, but I'm not considered a credible source.

From Yahoo Finance June 18 (summary in my words):

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-stall-as-fed-holds-rates-steady-forecasts-2-cuts-in-2025-180946600.html

Effective tariff rate per JPMorgan estimates: 2.5% at the beginning of 2025., 10.3% before "Liberation Day" April 2, then since then it's been essentially 23.7% until May 12 when it dived to the current 14.4% on a reset of China's reciprocal tariff to 10%. Graph starts in late March 2025, the other numbers come from the narrative